More Rates! How rates can help you build wealth OR build more debt! Read on.

Author: Andrew Lee

About 3 minutes read.

You may hear of Rule 72, or Compound interest, or other name like Time Value, Discounted Cash Flow or Future Value in various articles, websites, or forums. What do they really mean? Here, I hope a simple explanation could easily help you understand how "rate" could work for you or against you without a complex calculator or spreadsheet. In other word, you can simply process the numbers in your mind in seconds.

We all know when you get a loan (e.g. mortgage, personal line credit, HELOC/home equity loan, etc.), there is an annual (could also be daily, monthly, etc.) interest rate. When you look at investments, usually there are a hypothetical rate of return the investor would expect. The effect of the rate is actually compounded in most cases. Another type is what so called "simple interest" which the interest is calculated based on the principle at the end of the term, but not on the accumulated interest. Already confused? No sweat, let's give you a simple example on a $100 investment or loan with a rate of 10% on a 5 years term:

Simple Intererst:

Interest paid yearly and principle is paid on the last day of the 5th year. (If the loan contract allows you to prepay principle anytime, you could lower your interest whenever you prepay partial balance).

Total interest paid is $50. But if you plan to repay some principle (e.g. $20 at the end of each year), you could lower your interest due to the drop in your balance. e.g.

As you can see, the interest you paid each year does not add back to the owing balance of $100. This is simple interest. All good so far? Simple interest is straight forward. The math for Simple Interest is:

Total Interest Paid =

Principle (P) x Interest Rate (R) x Term (year)

In the above example, we can apply the math equation P x I x T which is $100 x 10% x 5 = $50.

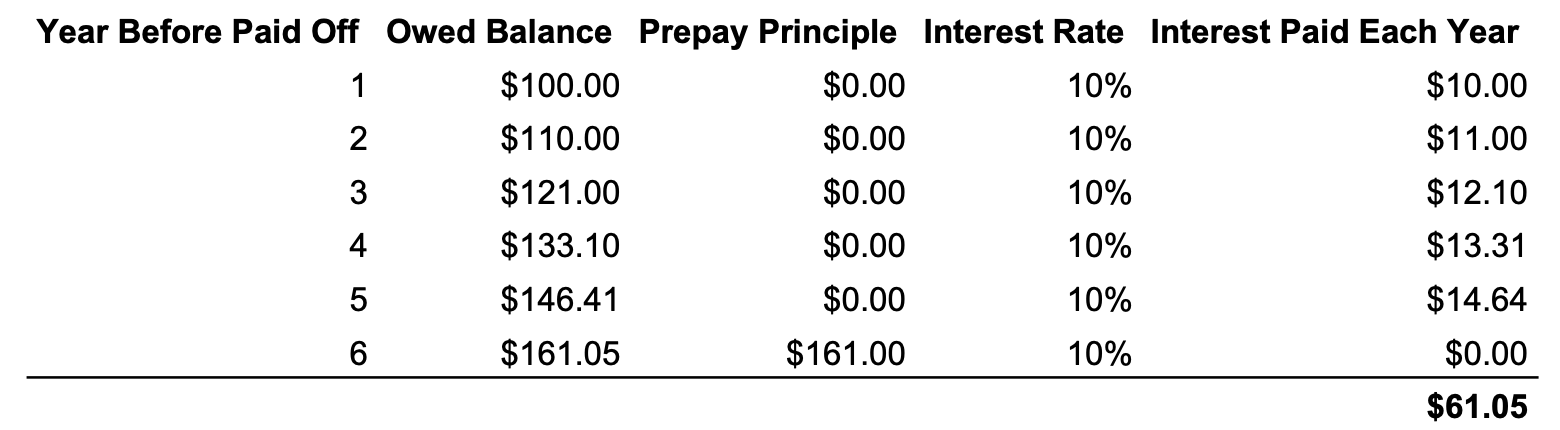

Now, what if this is a Compound Interest? The accumulated interest owed is now added back to the principle to calculate the interest for the next year and so on. The balance increase every term (e.g. year) with the interest occurs.

In real life, these are easily calculated by spreadsheets/calculators or computers, and you can simply type in and derive the total balance with different rates, however, a very easy and intuitive way to derive a result or grasp of your debt or return can simply divide the magic number 72 by the rate (loan interest rate or rate of return on your investment), the number you get is the year for your debt or investment to double, more or less. The following table shows an example of different rate 7.2%, 12%, 18% dividable by 72 for demonstration.

Like our articles? Please subscribe to our newsletter and blog here.

%20featuring%20a%20symbolic%20scene%20with%20a%20group%20of%20diverse%20individuals%20and%20families%20interacting.webp)

Comments

Post a Comment